Key takeaways:

- Regional trends demand localized budget power

- OTAs escalate with $17B marketing power

- Integrated acquisition mix drives profitable growth

- Future success requires bold, data-driven investment

The 2026 hospitality paradox

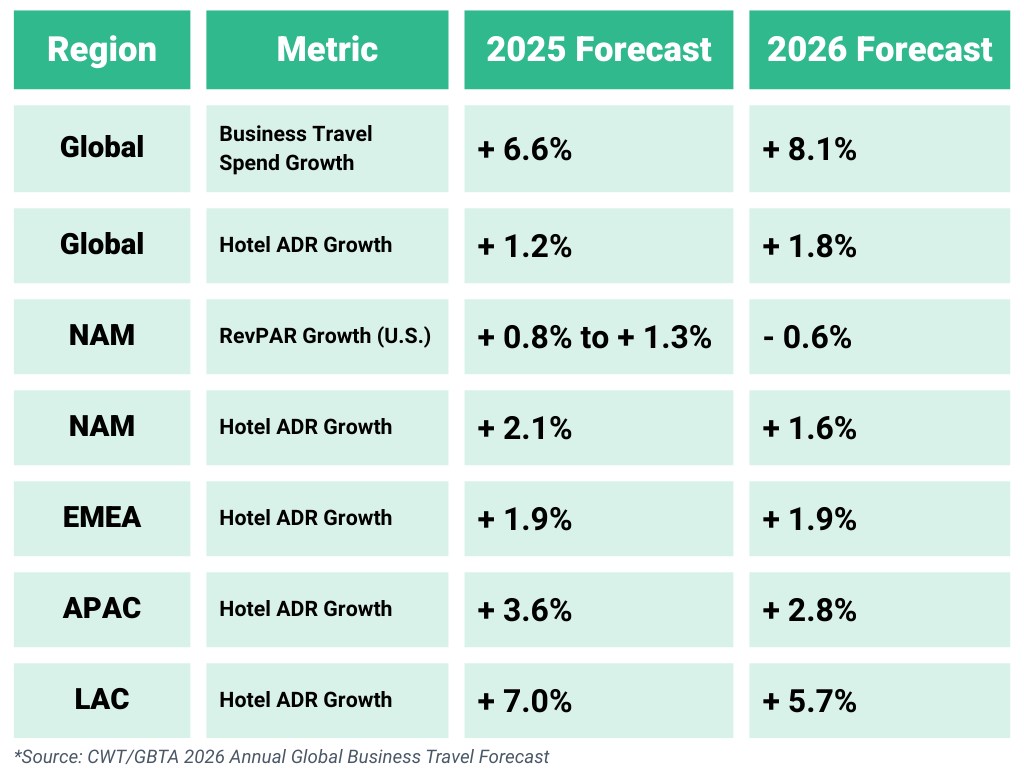

As the hospitality industry heads into its 2026 budget cycle, it faces a paradox: strong, sustained travel demand is colliding with economic complexity and tougher competition. Global business travel spending is projected to hit a new high of $1.57 trillion in 2025, yet inflation and tighter household budgets are slowing RevPAR growth forecasts in key markets. The result is a fragmented marketplace, with some travelers chasing deals while others splurge on premium experiences.

Success in this critical budget cycle won’t come from blanket cost-cutting. Instead, it will require a shift toward smart, data-driven investments—especially in customer acquisition. The ability to target the right travelers with precision will set leaders apart, and this article lays out a blueprint for making it happen.

The global chessboard: Why averages are deceiving

Basing budgets on global averages is risky. Travel demand looks very different across regions, and success depends on understanding those local shifts.

- North America (NAM): The market exemplifies a clear split between luxury and economy hotels. Moderating overall growth masks a deep split: the luxury segment’s RevPAR is growing at 7.1%, while economy hotels are flat. A strong pivot to domestic travel intensifies the battle for high-value leisure and corporate travelers.

- Europe, Middle East & Africa (EMEA): This region presents a study in contrasts. Mature European destinations are dealing with overtourism, creating opportunities for existing operators to prioritize rate integrity. Simultaneously, the Middle East is in an unprecedented hospitality boom, guaranteeing a hyper-competitive future focused on driving occupancy.

- Asia-Pacific (APAC): While leading global travel intent with a 34% year-on-year increase in 2025 bookings, the defini1.ng trend is a decisive shift toward the higher end of the market. Competition is now about the quality and uniqueness of the experience.

- Latin America (LAC): LAC has emerged as a hotbed of experiential travel, driven by “live tourism” around concerts and festivals. A surge in hotel construction guarantees a fiercely competitive future as global brands vie for a share of this booming market.

The digital arena: Defending your brand in the $17 billion OTA war

The battle against OTAs is escalating. In 2024, the top four OTA groups invested a staggering $17.8 billion in marketing, a pace that continued into 2025. This budget is now used to move up the marketing funnel, with heavy investment in AI and social media to intercept travelers at the earliest stages of inspiration. This strategy, combined with rising digital ad costs, means a purely defensive, bottom-funnel approach is no longer sufficient. Hotels must invest in a full-funnel digital strategy to compete for the traveler’s attention early in their journey.

The Acquisition Studio blueprint: An integrated framework for profitable growth

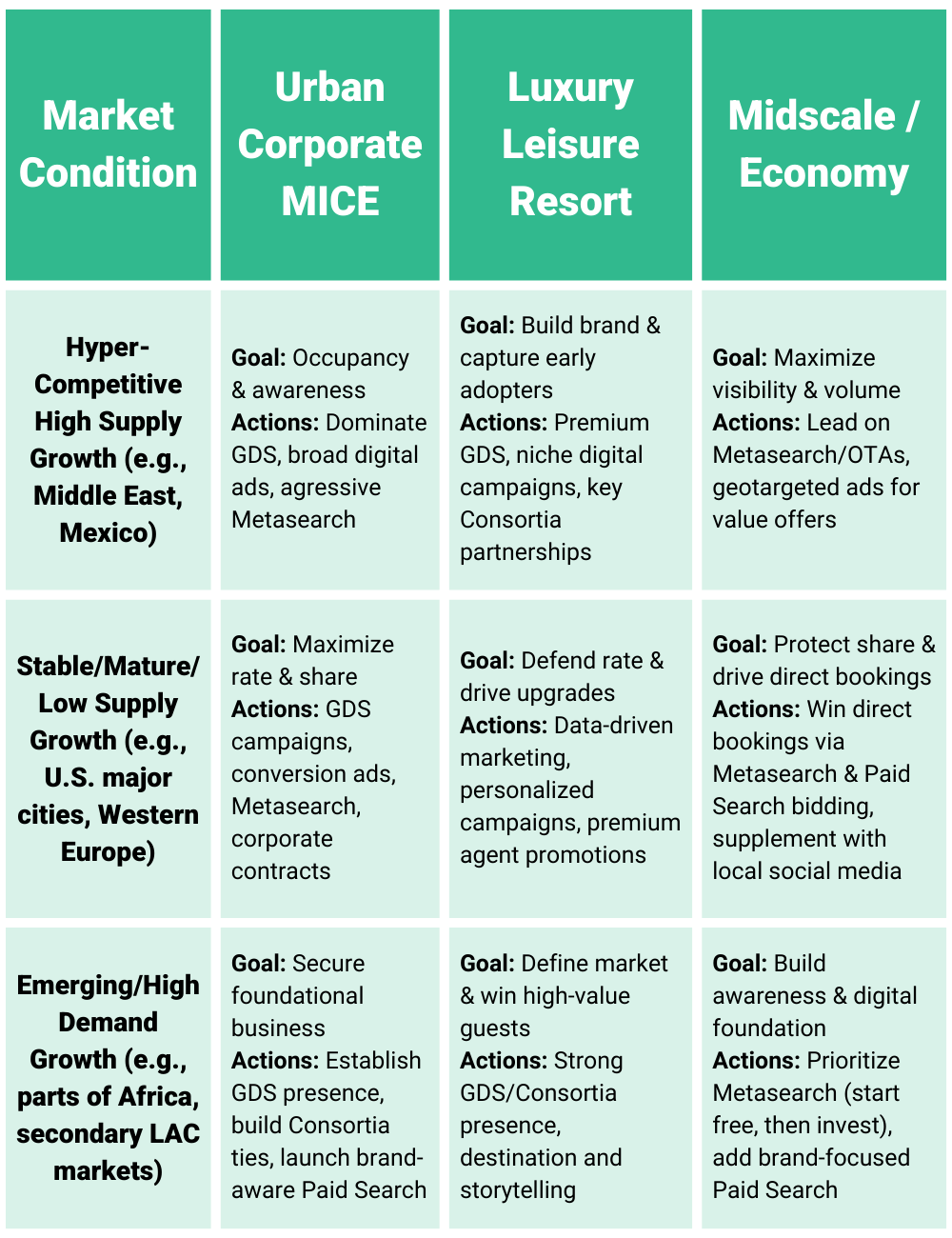

Navigating this landscape demands an integrated strategy that optimizes the profitability of the entire acquisition portfolio, not just a single channel.

- GDS Media: A Pillar for Corporate & Agency Demand: GDS Media is the foundational pillar for securing high-value corporate and agency demand. It provides direct access to a global network of professional bookers who deliver predictable, high-ADR stays. A multi-faceted budget is required for market presence, premium placements, and tactical campaigns.

- Digital Marketing: The Offensive & Defensive Play: Digital marketing is the dynamic engine of a modern acquisition strategy. Defensively, it protects brand equity from OTA encroachment through brand-focused Paid Search and Metasearch. Offensively, it generates new, high-margin direct bookings. A fluid, rolled-up digital media budget allows for nimble fund allocation to the channels with the most demand.

- Consortia: The Strategic Partnership: Participation in consortia programs is a strategic investment in long-term partnerships with leading Travel Management Companies (TMCs). These programs provide unparalleled access to lucrative corporate accounts and high-end leisure travelers, requiring a forward-looking budget that aligns with evolving standards like ESG criteria.

Building your 2026 budget: A framework for strategic investment

Translating analysis into a defensible budget requires a structured framework.

- Budget by Objective, Not Just by Channel: Shift from channel-based questions (“How much for Google?”) to strategic ones: “What is our budget to defend our brand?” or “What is our budget to grow our corporate base?”

- Balance Defense and Offense: Explicitly allocate funds for both defensive plays (the cost of doing business, like branded paid search) and offensive investments in growth (GDS media, top-funnel awareness).

- Fund Agility & Innovation: Earmark 10-15% of the total spend as a flexible fund for tactical opportunities and innovation, allowing you to capitalize on market shifts or experiment with new technologies.

2025 to 2026 hospitality KPI forecast summary (global & regional)

Strategic acquisition budgeting matrix

The future is booked by the bold

The 2026 hospitality landscape is complex, but the greatest risk is not overspending, it’s underinvesting. Reactive cost-cutting and outdated budget models lead to stagnation and margin erosion. The analysis is clear: the market is regional, the traveler is fragmented, and the competition is spending billions to own the customer relationship.

Thriving in this new era requires elevating the acquisition budget from a line item to the primary strategic weapon for driving profitable growth.

The hoteliers who will win will be those who embrace this complexity with a bold, data-driven, and integrated strategy, building a foundational base of high-value business through GDS and Consortia channels while waging a full-funnel digital war to defend their brand. The future of hospitality will be booked by those who invest in it today.

Related articles:

Written by Dhairya Raja

Get started now

Using Consortia Services and GDS Media can help your hotel increase visibility, boost business travel revenue, stay on budget, and compete with larger chains.